BlueHost is one of the leading hosting service provider and recommended by WordPress since 2005. BlueHost offers an easy affiliate marketing program to help site owners make money online from their website/blog by recommending Bluehost services.

BlueHost offers you $65 per referral. If you refer 1 customer per day, you can get 30 x 65 = $1950 commission per month.

Why to Join BlueHost Affiliate Program?

- Its Free to Join – It takes only minutes in Signing up and is entirely free.

- Unlimited Earnings – There is no cap on the amount of commissions you receive.

- Dedicated Team – Anytime you can get free support and advice from their affiliate experts.

- Proven Success – Over $5 million paid out in commissions last year.

Sign Up BlueHost Affiliate Program

Once you singed up for the program it is mandatory to submit your tax form in order to get your commission/payment from BlueHost.

How to fill out BlueHost Affiliate Tax form for Non-US Residents

Login to BlueHost Affiliate panel, here you will be asked to fill out the tax form and a notice like this “Our records indicate we do not have a tax form on file for your account. In order to receive payment for any referrals you must complete the required form. There are two forms to select from:

- W-9 form: For US person or business (citizen, resident alien, corporation, etc.)

- W-8BEN form: For non U.S.Persons

Here you will have to select W-8BEN form: For non U.S.Persons. This article explains how to fill W-8BEN tax form for those people who are living outside United States.

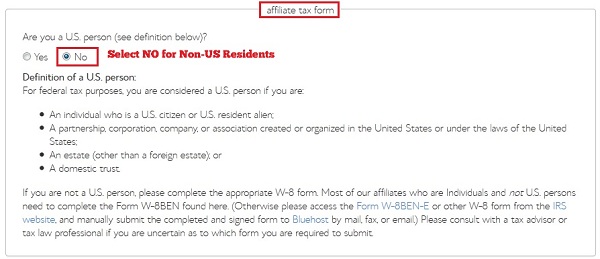

Step-1: In an affiliate Tax form select “No” which signifies that you are not a US resident and Form W-8BEN will appear as shown below.

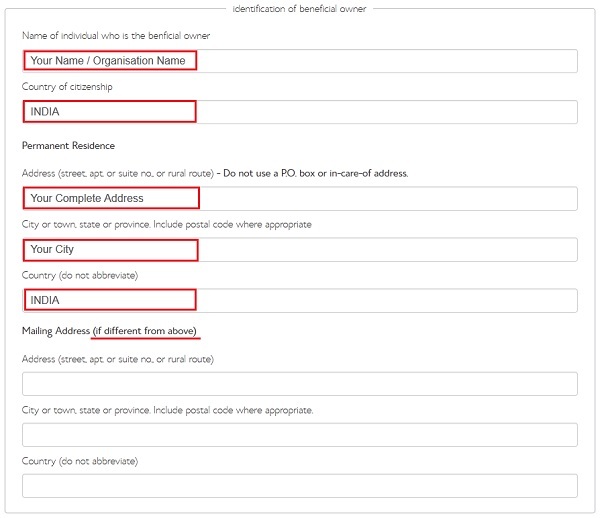

Step-2: Fill up the form with correct details like name, permanent address and country. You can find official instruction here.

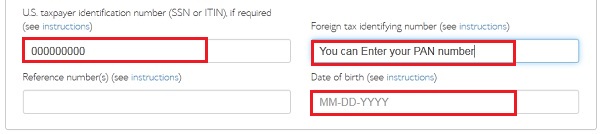

Step-3: This portion of the form is very important and critical. If you fail to complete it correctly, you can’t submit the form. Here you need to enter either SSN or ITIN. If you are from INDIA or any other sub continent country, you don’t have to be disheartened.

You have to simply fill “NINE ZEROs” I mean “000000000” and it will make you get through the completion process.

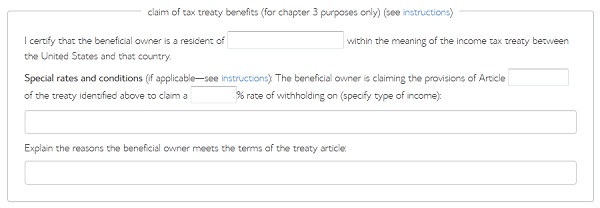

- As you are from India, so you need to keep all the fields under the “claim of tax treaty benefits” blank.

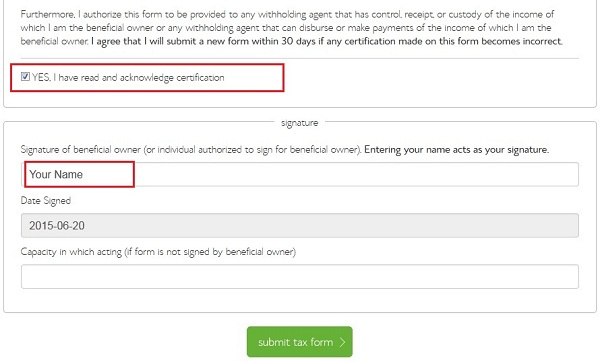

- Scroll down at the bottom of the form and acknowledge the certification by checking the checkbox. Make sure to read first the certification before you check.

- In the signature field, write your complete name that will work as an authorized signature.

That’s it, your tax form has been submitted to Bluehost, you will have to wait a day or more to verify your account. They will notify you by email if there’s any problem with your tax form you submitted.

You can share this guide with your friends or colleagues who want to earn $1950 commission per month online.

Thanks for your help….

I’m a Pakistani….so shall I write NTN (National tax number) in foreign tax identifying number??

and what is PAN number by the way?